Sign up for daily news updates from CleanTechnica by email. Or follow us on Google News!

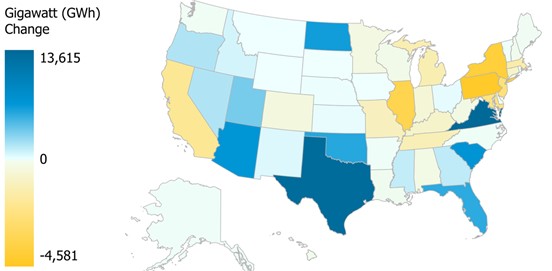

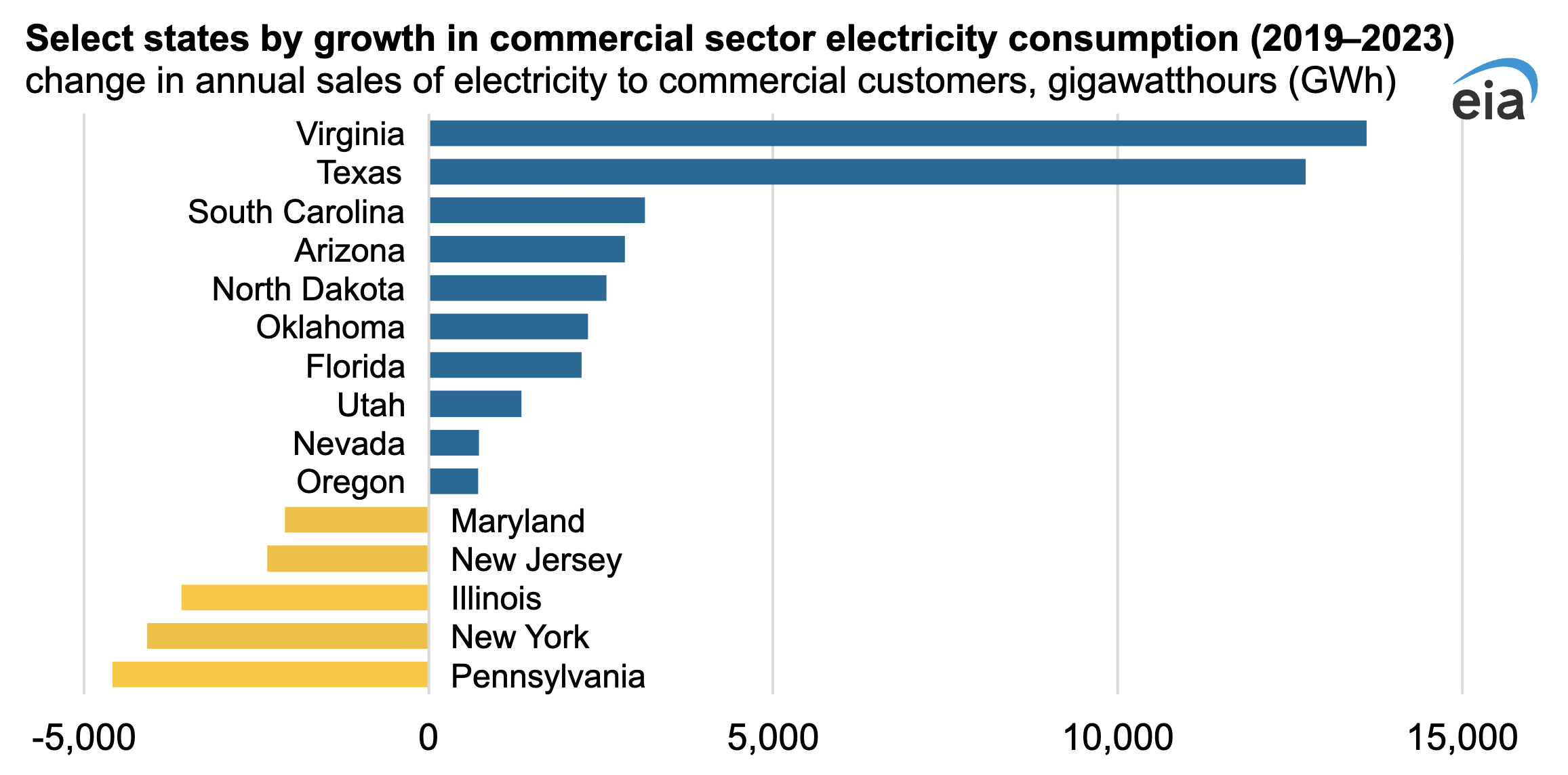

US commercial electricity consumption has recovered from pandemic levels, with annual US electricity sales to commercial customers in 2023 reaching 14 billion kilowatts (BkWh), or 1%, more than in in 2019. However, the growth in commercial electricity demand is concentrated in a handful of countries that are experiencing rapid development of large-scale computing facilities such as data centers. Electricity demand increased the most in Virginia, which added 14 BkWh, and Texas, which added 13 BkWh. Based on our expectations that regional electricity demand will increase, we revised our upward projections for commercial electricity demand to 2025 in our June Short Term Energy Outlook (STEO).

Commercial electricity demand in the 10 states with the largest increases in electricity demand increased by a total of 42 BkWh between 2019 and 2023, representing a 10% increase in those states over that four-year period. In contrast, demand in the other forty states decreased by 28 BkWh over the same period, a decrease of 3%. Although growth in the top 10 states has been fairly consistent over time, commercial electricity consumption fell between 2022 and 2023 in some due to mild summer weather.

Electricity demand has grown the most in Virginia, driven largely by Dominion Energy Virginia, the state’s main electric utility. Virginia has become a major hub for data centers, with 94 new facilities connected since 2019 with access to a densely packed fiber backbone and four submarine fiber cables.

Demand for electricity also increased significantly in Texas, where relatively low costs for electricity and land have attracted a high concentration of data centers and cryptocurrency mining operations. North Dakota stands out with the fastest relative growth at 37% (2.6 BkWh growth) between 2019 and 2023, attributed to the establishment of large computing facilities in the state. In addition, western states such as Arizona and Utah have shown strong growth in commercial electricity demand, further contributing to overall growth in the top 10 states.

In contrast, commercial electricity demand in several large states such as New York, Illinois and California has been flat or down compared to 2019.

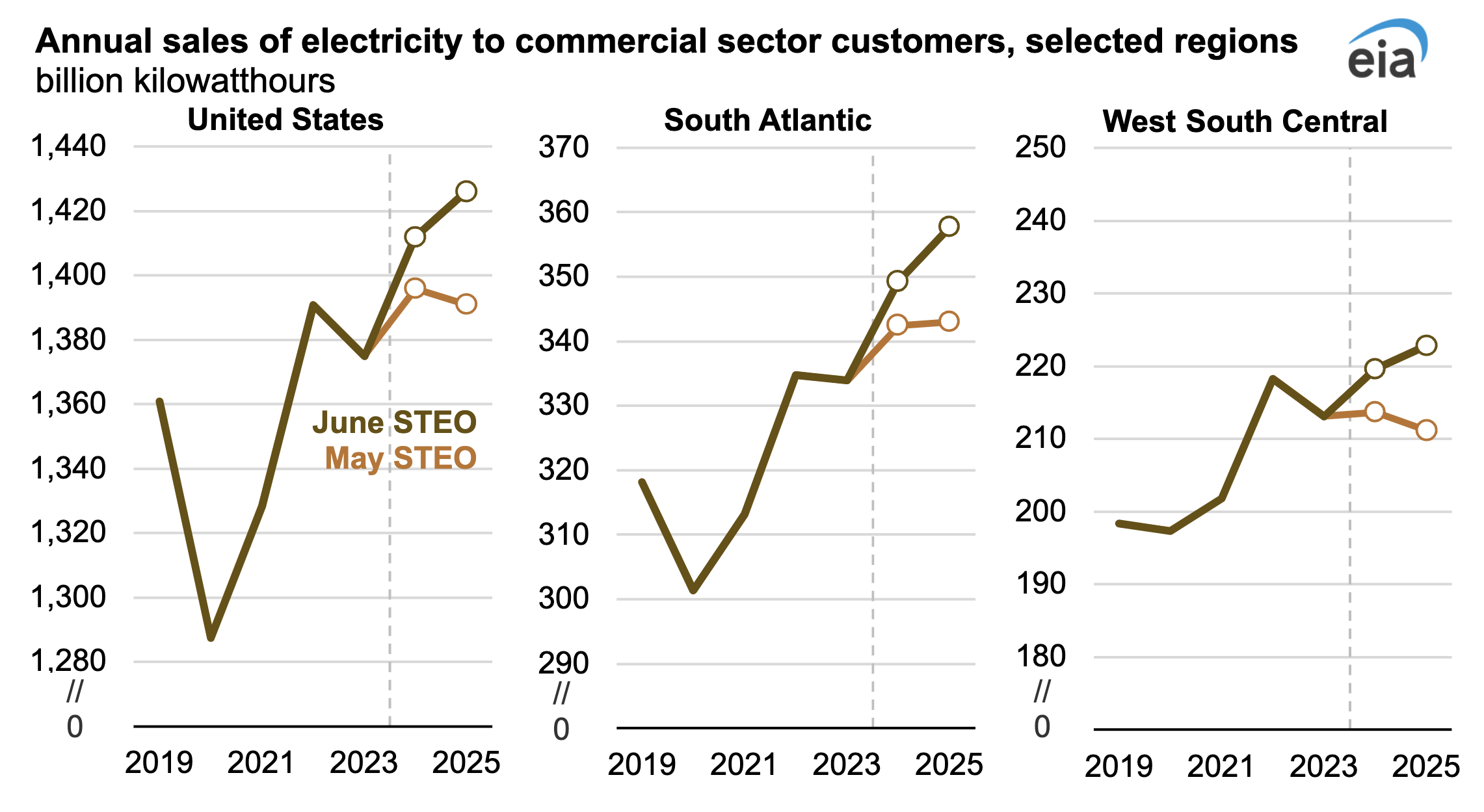

We provide monthly forecasts of retail electricity sales by sector for our country’s nine census divisions Short Term Energy Outlook. After reviewing information and projections from utilities and grid operators in the country’s rapidly growing data center areas, we revised our upward projections for commercial electricity demand through 2025.

We made our largest forecast revisions in the South Atlantic and Midwest census divisions, which together account for 40% of US commercial electricity demand. We now expect commercial consumption in the South Atlantic to grow by 5% in 2024 and 2% in 2025 and in the South West by 3% this year and 1% next year. Other regions with strong growth in commercial electricity sales include the North Central and Mountain West recording divisions (both with projected annual average growth of 3% in 2024 and 2025).

Nationally, we expect US electricity sales to the commercial sector to grow by 3% in 2024 and by 1% in 2025. Data center developments are evolving rapidly and we plan to re-evaluate our future forecasts as we get more information.

Main contributors: Nilay Manzagol, Tyler Hodge

Maps: Jim O’Sullivan

ARTICLE BY Today in Energy

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

CleanTechnica.TV’s latest videos

CleanTechnica uses affiliate links. View our policy here.

#Commercial #electricity #demand #grew #fastest #United #States #rapid #growth #computer #equipment #CleanTechnica

Image Source : cleantechnica.com